Appendix A

Governance and Finances

Governance

ICI is a 501(c)(6) organization that represents regulated investment companies on regulatory, legislative, and securities industry initiatives that affect funds and their shareholders. ICI members include mutual funds, exchange-traded funds, closed-end funds, and sponsors of unit investment trusts in the United States; similar funds offered to investors in jurisdictions worldwide; and their investment advisers and principal underwriters.

The Institute employs a staff of approximately 180 (see Appendix F). The ICI president and staff report to the Institute’s Board of Governors, which is responsible for overseeing the business affairs of ICI and determining the Institute’s positions on public policy matters (see Appendix B).

ICI’s Board of Governors is composed of 57 members, representing ICI member companies and independent directors of investment companies. Governors are elected annually to staggered three-year terms. The board is geographically diverse and includes representatives from large and small fund families, as well as fund groups sponsored by independent asset managers, broker-dealers, banks, and insurance companies. This broad-based representation helps to ensure that the Institute’s policy deliberations consider all segments of the fund industry and all investment company shareholders.

Five committees assist the Board of Governors with various aspects of the Institute’s affairs. These include an Executive Committee—responsible for evaluating policy alternatives and various business matters and making recommendations to the Board of Governors—as well as Audit, Compensation, Investment, and Nominating committees. Other than the Institute’s president, who is a member of the Executive Committee, all members of these committees are governors. The board also has appointed the Chairman’s Council to administer the Institute’s political programs, including the political action committee, ICI PAC. The council includes 12 governors, the treasurer of ICI PAC, and the Institute’s president (ex officio).

To provide strategic direction to ICI’s international program, the ICI Global Policy Council takes the lead in setting the program’s priorities and coordinating initiatives worldwide, subject to the Executive Committee’s review and approval (see Appendix E).

ICI addresses the needs of investment company independent directors through the Independent Directors Council (IDC). IDC organizes educational programs, keeps directors informed of industry and regulatory developments, assists in the development and communication of policy positions on key issues for fund boards, and promotes greater understanding of the role of fund directors. IDC’s Governing Council, made up of four committees, helps set IDC’s priorities in these areas (see Appendix D).

Twenty-seven standing committees, bringing together more than 2,500 industry professionals, guide the Institute’s policy work. ICI standing committees perform a number of important roles, including assisting with formulation of policy positions, and gathering and disseminating information on industry practices (see Appendix C). In addition, 62 industry advisory committees, task forces, forums, and working groups with more than 4,200 participants tackle a range of regulatory, operations, and business issues. In all its activities, ICI strictly observes federal and state antitrust laws, in accordance with a long-standing and well-established compliance policy and program.

Finances

Throughout its history, the Institute has sought to prudently manage its financial affairs in a manner deemed appropriate by the Board of Governors, which is responsible for approving ICI’s annual budget and its member net dues rate. The Board of Governors considers both the Institute’s core and self-funded activities when approving the annual net dues rate.

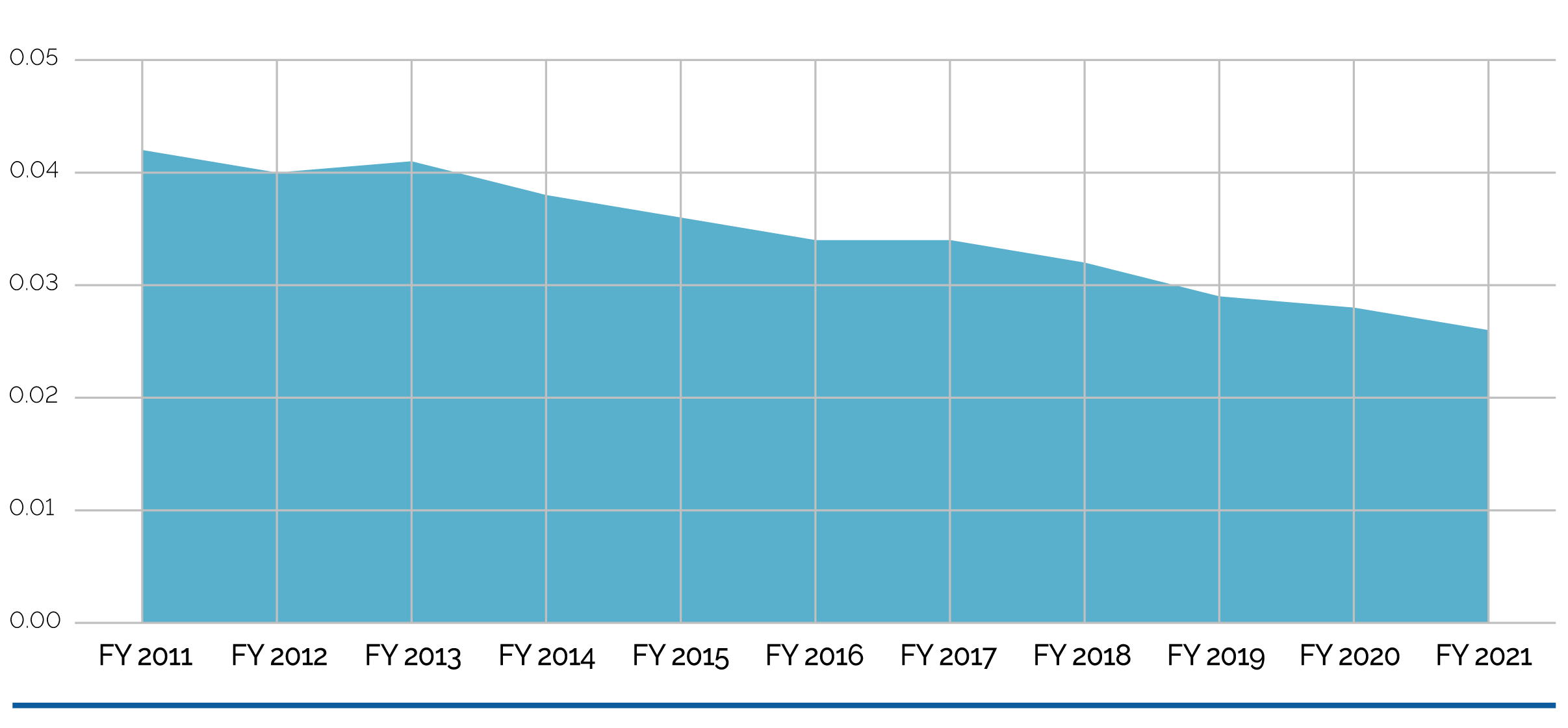

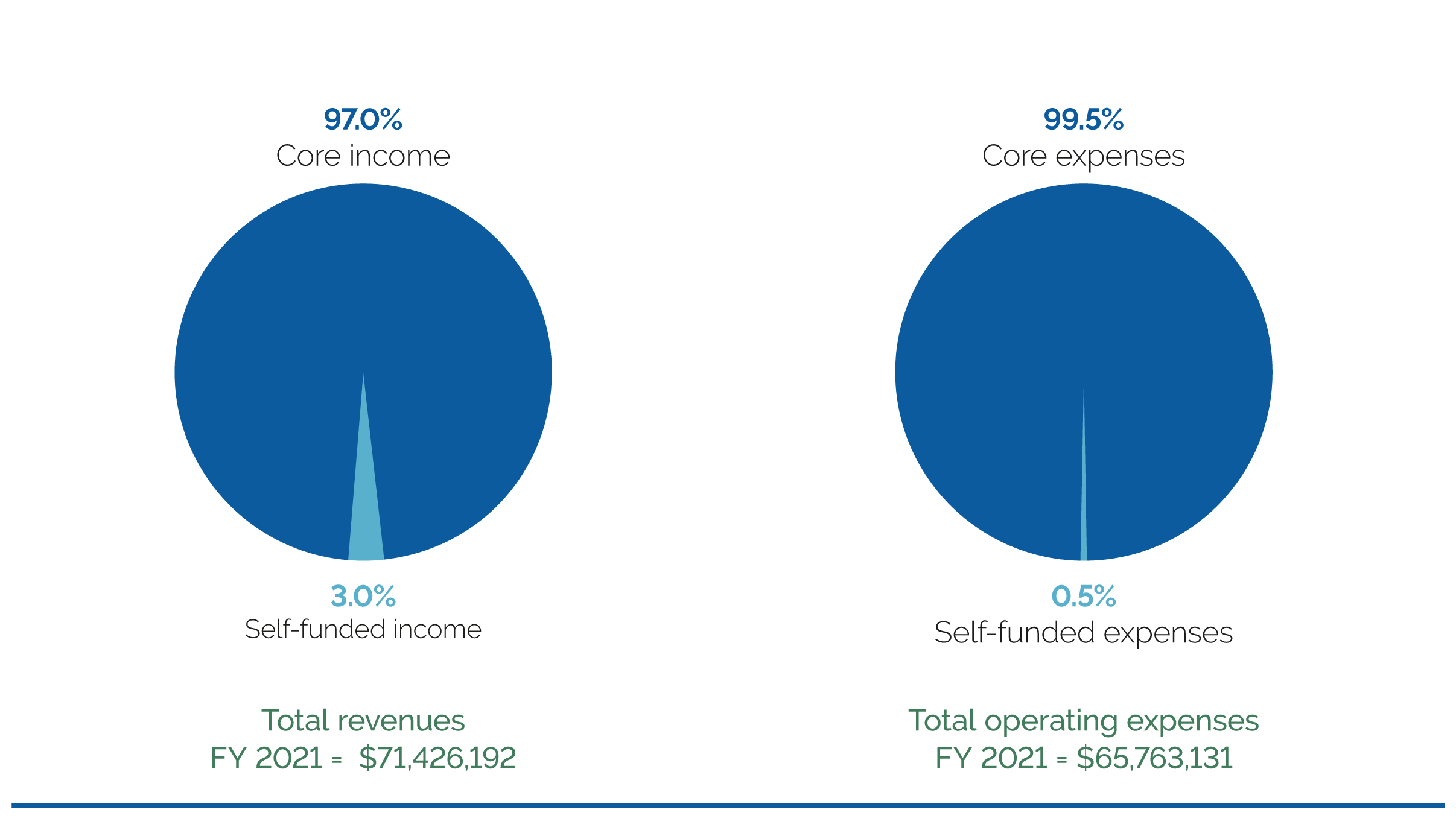

Core activities are related to public policy and include regulatory, legislative, operational, economic research, and public communication initiatives in support of investment companies and their shareholders, directors, and advisers. Reflecting the Institute’s strategic focus on issues affecting investment companies, the Board of Governors has chosen to fund core activities with dues rather than seeking alternative sources of revenues, such as sales of publications, and strives to keep the level of dues relatively flat when compared to industry assets under management (see Figure 1). The significant majority of ICI’s total revenues in FY 2021, 97 percent, comes from dues, investment income, royalties, and miscellaneous program sources. Similarly, by design, 99.5 percent of the Institute’s total resources in FY 2021 are devoted to core activities (see Figure 2).

FIGURE 1

Member Dues Relative to Assets Under Management Have Declined

Basis points

FIGURE 2

Member Dues Support Significant Majority of Core Activities at ICI

Core expenses support the wide range of initiatives described in this report. Self-funded activities (e.g., conferences, special surveys) are supported by separate fees paid by companies and individuals who participate in these activities. The financial goal for self-funded activities is that fees should cover all direct out-of-pocket costs and provide a margin to cover associated staff costs, to ensure that these activities are not subsidized by member dues.

Unaudited Financial Statements

Statement of Financial Position |

|

|

Assets |

|

|

Cash and cash equivalents |

$978,404 |

|

Investments, at market value |

64,537,114 |

|

Accounts receivable |

1,305,542 |

|

Prepaid expenses |

2,803,396 |

|

Other assets |

3,639,146 |

|

Furniture, equipment, and leasehold improvements, net |

|

|

2,843,591 |

|

|

Total assets |

$76,107,193 |

|

Liabilities and Net Assets |

|

|

Payroll and related charges accrued and withheld |

7,306,216 |

|

Accrued pension and postretirement liability |

16,267,654 |

|

Accounts payable and accrued expenses |

2,258,232 |

|

Deferred revenue |

505,823 |

|

Rent credit |

1,271,479 |

|

Deferred rent |

5,162,887 |

|

Total liabilities |

32,772,291 |

|

Net Assets |

|

|

Undesignated net assets |

42,334,902 |

|

Board designated net assets |

1,000,000 |

|

Total net assets |

43,334,902 |

|

Total liabilities and net assets |

$76,107,193 |

Statement of Activities and Changes in Net Assets |

|

|

Core Income |

|

|

Membership dues |

$66,997,124 |

|

Investment income |

190,873 |

|

Royalty income |

834,074 |

|

Program income |

1,260,523 |

|

Total core income |

69,282,594 |

Core Expenses |

|

|

Administrative expenses |

58,150,077 |

|

Program expenses |

5,165,098 |

|

Depreciation and taxes |

2,147,069 |

|

Total core expenses |

65,462,244 |

|

Change in net assets—core |

3,820,350 |

Self-Funded Income |

|

|

Conferences |

2,052,600 |

|

Other self-funded income |

90,998 |

|

Total self-funded income |

2,143,598 |

Self-Funded Expenses |

|

|

Conferences |

250,146 |

|

Other self-funded expenses |

50,741 |

|

Total self-funded expenses |

300,887 |

|

Change in net assets—self-funded |

1,842,711 |

|

ICI strategic review expenses |

(875,000) |

|

Change in net assets from operations |

4,788,061 |

|

Loss on currency conversion |

(14,719) |

|

Other components of net periodic cost |

(670,002) |

|

Change in net assets |

4,103,340 |

|

Net assets, beginning of year |

39,231,562 |

|

Net assets, end of year |

$43,334,902 |

These financial statements are preliminary unaudited statements as of September 30, 2021. Audited financial statements for the fiscal year ended September 30, 2021, will be available after February 1, 2022. To receive copies of the audited statements, please contact Mark Delcoco.